Governance

Corporate Governance

Basic Approach

Under the Purpose: Empower society, encourage progress, the MITSUI-SOKO Group

aims at sustainable growth and medium- to long-term enhancement of corporate

value, emphasizes group governance as the foundation of management, and promotes

the development of systems and commitment to various initiatives. Our basic

approach to corporate governance and detailed information on this topic are

disclosed externally through the Corporate Governance Guidelines and the Report

on Corporate Governance.

※Please refer to the List of

Policies page for related materials.

Framework

As a holding company, MITSUI-SOKO HOLDINGS has established a group governance

policy to ensure appropriate management and control of each subsidiary within

the Group. By clarifying the responsibilities and authority to be assumed by

each company in our Group, we will strive to promote group governance and

improve corporate value over the medium to long term. We also work to strengthen

corporate governance by establishing various committees, introducing an

executive officer system to separate business execution and supervision, and

clarifying the executive authority and responsibilities of directors and

executive officers. For internal control, we have established its basic policy

and strive to maintain an appropriate internal control system through

cooperation between auditors and departments in charge of departmental audits

and internal control.

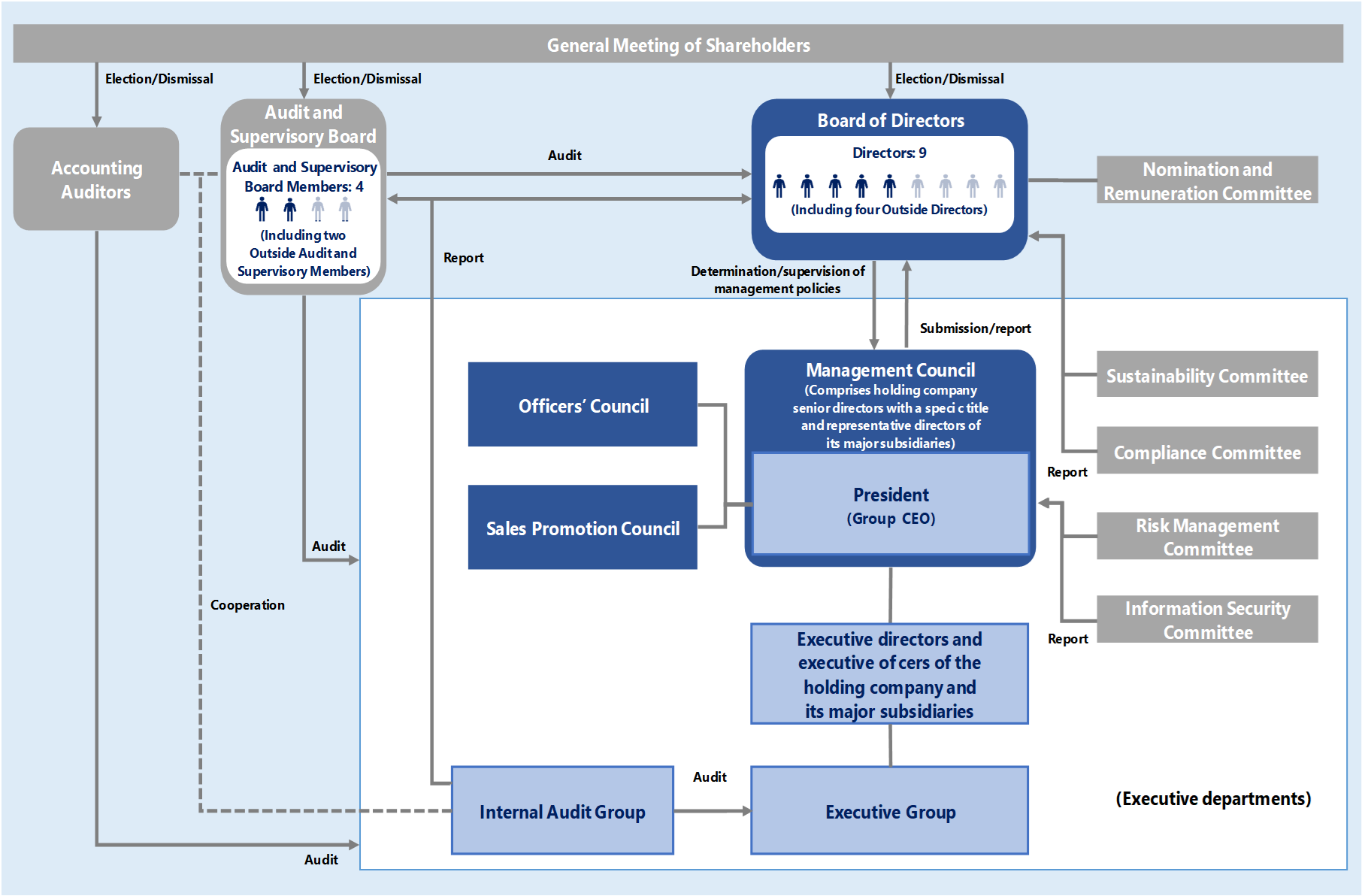

Corporate Governance Framework Chart (as of June 26, 2025)

| Board of Directors | Determines basic management policies and important business execution, while overseeing the execution of duties by the representative director and president, and executive directors. |

|---|---|

| Audit and Supervisory Board | Striving to enhance audits, members of the Audit and Supervisory Board attend Board of Directors' meetings, the Officers' Council, and other important meetings while overseeing the directors in the execution of their duties. |

| Management Council | Discusses or resolves matters to be submitted to the Board of Directors, important matters related to overall management, and matters delegated to the Management Council by the directors. |

| Sales Promotion Council | The members of the Council share information that assists in the compilation of monthly performance and quarterly forecasts, in budget management, and that helps in sales expansion and cross-sectional sales promotions. |

| Officers' Council | The members exchange information intended to ensure familiarity with important items covering the Group's management overall and to promote mutual understanding of the Group's conditions. |

| Nomination and Remuneration Committee | The Committee raises the objectivity and transparency of the process for selecting directors and enhances the objectivity and transparency of the directors' remuneration decision process, such as by considering the validity and appropriateness of performance-linked compensation. |

| Risk Management Committee | The Committee appropriately confirms risks in business activities, establishes measures to respond to relevant risks, manages the progress and results of those measures, and prepares and updates manuals to prevent and prepare for risks. |

| Compliance Committee | The Committee discusses compliance violations affecting the Group's management and ways of responding, establishes corporate codes of conduct, develops a compliance system, promotes respect for compliance, and works to prevent compliance violations. |

| Information Security Committee | The Committee sets up a system related to the Group's information security management, promotes and reviews activities, and protects personal information and corporate information. |

| Sustainability Committee | The Committee works to improve the Group's corporate value through discussions on sustainability-related strategies and policies of the Group, and implementation and management of initiatives to address the materiality and target KPIs. |

Operational Status of the Board of Directors

The Board of Directors discusses management strategies, business investments,

and other important matters related to Group management, as well as reports on

the execution of duties by each director and business performance on a regular

basis. As an effort to stimulate lively discussions at Board of Directors

meetings, materials are distributed to directors and auditors in advance. In

addition, training on corporate management, including governance and

sustainability, and periodic explanations of the business overview of Group

companies are conducted to improve the abilities of all officers and promote

mutual understanding among Group companies.

Effectiveness of the Board of Directors

To enhance the function of the Board of Directors for medium- and long-term

improvement of corporate value, its effectiveness is assessed annually. The

directors and auditors are evaluated through questionnaires and interviews, and

these results are discussed by the Board of Directors.

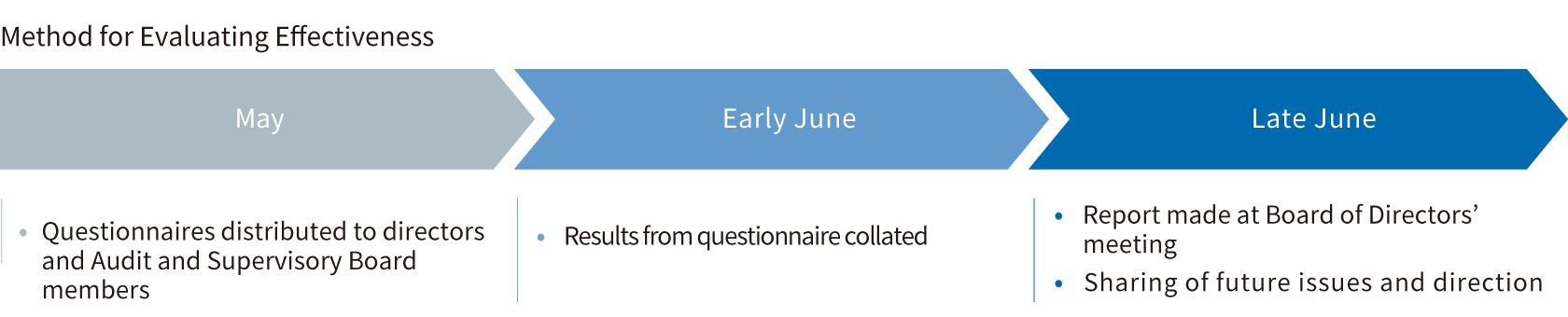

Effectiveness Assessment Process

Overview of Effectiveness Assessment

Main Contents of Questionnaire

- Structure and operational methods of the Board of Directors

- Content of agendas

- Director compensation, election and dismissal, etc.

- Progress of the Medium-term Management Plan 2022

- DX, sustainability, and human capital

- Status of discussions at the Board of Directors' meetings

Result of Evaluation

- By providing prior briefings and delegating authority, we were able to enrich the content of the discussion and take sufficient time to discuss strategically important topics in the Medium-term Management Plan.

- DX promotion involves a wide range of issues and rapid changes, making it difficult to make decisions on the return on investment. This makes it necessary to regularly check the positioning and policy of DX and discuss the progress of measures.

- With regard to sustainability, a mechanism has been put in place to facilitate discussion, and ongoing regular information sharing and discussion forums are desirable. Further discussion on strategies for improving and upgrading human capital will be needed going forward.

- The briefings on the status of dialogue with investors are very helpful. In the future, we would like to invigorate discussions to gain understanding and recognition from a wider range of stakeholders, including investors.

Executive Structure

Directors

| Representative Director, President Executive Officer |

Hirobumi Koga |

|---|---|

| Representative Director, Senior Managing Executive Officer |

Nobuo Nakayama |

| Director, Managing Executive Officer |

Takeshi Gohara |

| Director, Managing Executive Officer |

Takeshi Nishimura |

| Outside Director | Taizaburo Nakano |

| Outside Director | Takashi Hirai |

| Outside Director | Maoko Kikuchi |

| Outside Director | Takashi Tsukioka |

| Outside Director | Junko Kai |

Audit and Supervisory Board Members

| Senior Standing Audit & Supervisory Board Member | Hiroshi Kino |

|---|---|

| Standing Audit & Supervisory Board Member | Fumio Misuge |

| Outside Audit & Supervisory Board Member | Hidetaka Miyake |

| Outside Audit & Supervisory Board Member | Ken Kawamura |

| Outside Audit & Supervisory Board Member | Masafumi Nakada |

※For more information on directors/auditors, please click here.

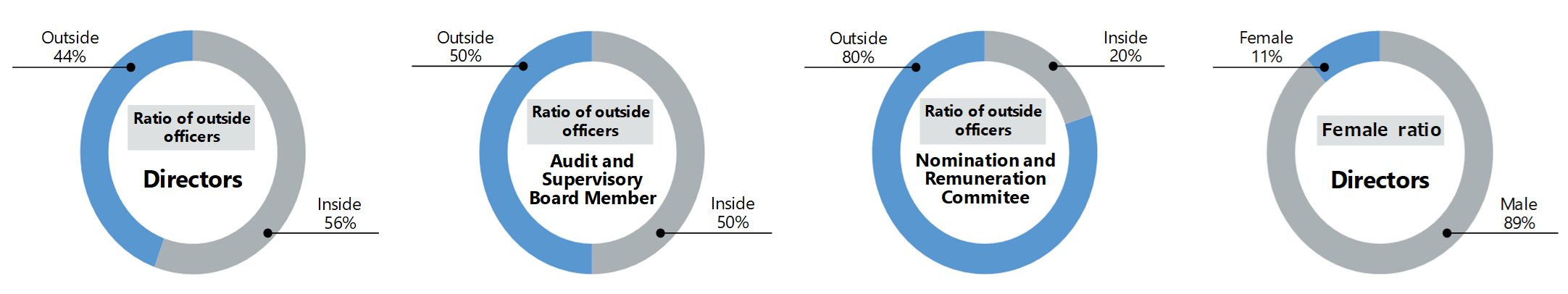

Composition of Directors and Auditors (as of June 26, 2025)

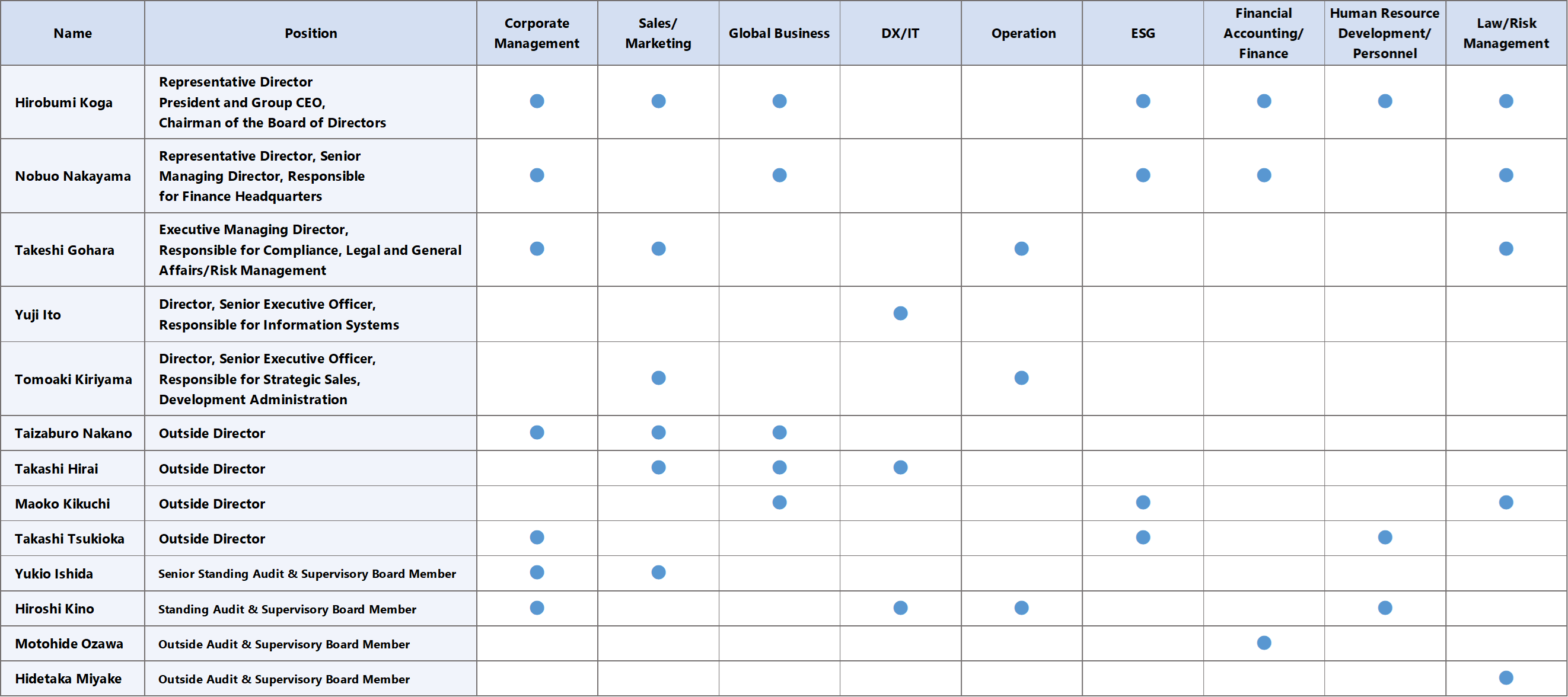

Competence and Diversity of the Board of Directors as a Whole (as of June 26, 2025)

We appoint our directors and auditors to ensure that the Board of Directors has

an overall balance of knowledge, experience, and abilities, is diverse in

gender, skills, and other areas, and has the appropriate size.

Note: The above list does not represent all the knowledge and experience

possessed by the directors and auditors.

Main Roles of Outside Directors and Reason for Appointment (as of June 26, 2025)

| Name | Independent Officer |

Years in office |

Reason for appointment | Attendance at Board of Directors’ meetings |

|---|---|---|---|---|

| Taizaburo Nakano |

○ | 7 | Mr. Taizaburo Nakano has served as a director at a beverage company for many years, and has rich experience as a corporate manager. Based on his experience and, in particular, in light of the supervision, advice, etc. he has provided the Group’s management policy from the perspective of a manager, the Company expects him to continue serving in the same capacity. Therefore, we have nominated him again as a candidate for outside director. In addition, if he is elected, the Company plans for him to be involved in selecting candidates for the Company’s officers and determining remuneration, etc. of officers from an objective and neutral standpoint as a member of the Nomination and Remuneration Committee. | 16/16(100%) |

| Takashi Hirai |

○ | 6 | Mr. Takashi Hirai has experience of practical business operations at various companies and consulting in a wide range of industries. He has conducted research on corporate strategies and business strategies at graduate schools. Based on his rich experience and insight, in particular, in light of the supervision, advice, etc. he has provided regarding the Group’s business strategies from the perspective of a professional, the Company expects him to continue serving in the same capacity. Therefore, we have nominated him again as a candidate for outside director. In addition, if he is elected, the Company plans for him to be involved in selecting candidates for the Company’s officers and determining remuneration, etc. of officers from an objective and neutral standpoint as a member of the Nomination and Remuneration Committee. | 16/16(100%) |

| Maoko Kikuchi |

○ | 5 | Ms. Maoko Kikuchi is licensed to practice law in Japan and the U.S. State of New York, and has been engaged in corporate legal affairs while working at the Public Prosecutor’s Office and the Fair Trade Commission. Furthermore, she has rich experience and insight gained as a standing outside audit & supervisory board member of the Company. Based on the valuable advice she has provided regarding the Group’s overall business activities utilizing her experience and insight, the Company expects her to continue serving in the same capacity. Therefore, we have nominated her again as a candidate for outside director. In addition, if she is elected, the Company plans for her to be involved in selecting candidates for the Company’s officers and determining remuneration, etc. of officers from an objective and neutral standpoint as a member of the Nomination and Remuneration Committee. | 16/16(100%) |

| Takashi Tsukioka |

○ | 2 | Mr. Takashi Tsukioka has extensive experience as a corporate manager, having served for many years as a director, and as president and chairman, of an energy company. Based on his experience and wide-ranging knowledge, the Company expects him to continue to play a similar role in the future based on his extensive track record in supervising and advising on the management policies and business strategies of our Group. Therefore, we have nominated him again as a candidate for outside director. In addition, if he is elected, the Company plans for him to be involved in selecting candidates for the Company’s officers and determining remuneration, etc. of officers from an objective and neutral standpoint as a member of the Nomination and Remuneration Committee. | 16/16(100%) |

| Junko Kai |

○ | - | Ms. Junko Kai possesses wide-ranging knowledge as a lawyer and extensive experience at the Legal Training and Research Institute, the Tokyo Family Court, the Ministry of Justice, the Ministry of Health, Labour and Welfare, and the Ministry of Land, Infrastructure, Transport and Tourism. Based on her knowledge and wide-ranging experience, the Company expects her to play a role in supervising and advising on the ESG, legal affairs, and risk management of our Group. Therefore, we have nominated her as a candidate for outside director. In addition, if she is elected, the Company plans for her to be involved in selecting candidates for the Company’s officers and determining remuneration, etc. of officers from an objective and neutral standpoint as a member of the Nomination and Remuneration Committee. | - |

Main Roles of Outside Audit & Supervisory Board Members and Reason for Appointment (as of June 26, 2025)

| Name | Independent Officer |

Years in office |

Reason for appointment | Attendance at Board of Directors’/ Audit & Supervisory Board meetings |

|---|---|---|---|---|

| Hidetaka Miyake |

○ | 2 | Mr. Hidetaka Miyake has wide-ranging knowledge as an attorney and extensive experience at the Public Prosecutors Office, the Securities and Exchange Surveillance Commission of the Financial Services Agency, and an auditing firm. The Company expects him to play an active role in improving the soundness, transparency and compliance of the governance of the Group through auditing from the perspective of law, risk management, and other areas. Therefore, we have nominated him as a candidate for outside audit & supervisory board member. | Board of Directors 15/16(94%) Audit & Supervisory Board 15/16(94%) |

| Ken Kawamura |

○ | - | Mr. Ken Kawamura has wide-ranging knowledge as a Certified Public Accountant (CPA) and extensive experience in the fields of accounting, auditing, taxation, and deal advisory services. The Company expects him to play an active role in improving the soundness, transparency and compliance of the governance of the Group through auditing from the perspective of finance and accounting, legal affairs, risk management, and other areas. Therefore, we have nominated him as a candidate for outside audit & supervisory board member. | - |

| Masafumi Nakada |

○ | - | Mr. Masafumi Nakada has extensive experience as corporate manager having served as Representative Director at a number of financial institutions and wide-ranging knowledge of finance, securities, trade, and other fields. The Company expects him to play an active role in improving the soundness, transparency and compliance of the governance of the Group through auditing from the perspective of sales, marketing, finance, accounting, legal affairs, risk management, and other areas. Therefore, we have nominated him as a candidate for outside audit & supervisory board member. | - |

Independence Standards for Outside Officers

MITSUI-SOKO HOLDINGS Co., Ltd. (“the Company”) has

established the Independence Standards for outside directors

and outside Audit and Supervisory Board members (hereinafter

collectively referred to as "outside officers") as follows. If an

outside officer does not fall under any of the following items,

the outside officer is deemed to have independence from the

Company.

- 1. A person who is or was an executive (*1) of the Company or any of its subsidiaries (hereinafter collectively referred to as the "Group");

- 2. An executive of a company for which an executive of the Group serves as an officer;

- 3. A person whose major business partner is the Group (*2) or an executive thereof, or a major business partner of the Group (*3) or an executive thereof;

- 4. A major lender of the Group (*4) or an executive thereof;

- 5. A consultant, accountant or legal professional who receives significant monetary or other property benefit (*5) from the Group in addition to officer’s remuneration (or in the case where the person who receives the said benefits is a juridical person, or an organization, etc., the person who belongs to said organization);

- 6. A person who is an employee, partner or staff of a certified public accountant (or tax accountant) firm or an auditing firm (or tax accountant corporation) who serves as accounting auditor or accounting advisor of the Group;

- 7. A person who receives a large donation (*6) from the Group;

- 8. An executive of a company whose major shareholder (*7) is the Group, or a major shareholder of the Group or an executive thereof;

- 9. A person who has fallen under any of the categories from 1 to 8 above in the last one year; or

- 10. A spouse, a relative within the second degree of kinship, or a cohabiting relative of a person who falls under any of the categories from 1 to 9 above.

-

- (*1) An “executive” means an executive director, officer, executive officer, an employee or other person who executes business.

- (*2) A “person whose major business partner is the Group” means a person/company that has received payment from the Group of not less than 2% of his/her/its annual consolidated net sales in the most recent fiscal year.

- (*3) A “major business partner of the Group” means a person/company that has made payments to the Group of 2% or more of the annual consolidated net sales of the Group in the most recent fiscal year of the Group.

- (*4) A “major lender of the Group” means a financial institution or any other large creditor who is essential to the Group’s financing and on whom the Group is dependent to the extent that there is no substitute.

- (*5) A “significant monetary or other property benefit” means money or other property benefit of 10 million yen or more in the most recent fiscal year.

- (*6) A “large donation” means a donation exceeding 10 million yen in the most recent fiscal year.

- (*7) A “major shareholder” means a shareholder who holds 10% or more of the voting rights (including indirect ownership) of the company.

November 22, 2021

MITSUI-SOKO HOLDINGS Co., Ltd.

MITSUI-SOKO HOLDINGS Co., Ltd.

Remuneration

Process for Determining Officer Remuneration

Our Board of Directors has resolved a policy for determining the remuneration of

individual directors. To further ensure the appropriateness of individual

remuneration and the transparency of the decision process, remuneration amounts

are decided at a Nomination and Remuneration Committee meeting—chaired by an

outside director and comprising other outside directors as well as the

President—and paid in accordance with those decisions.

Composition of Executive Remuneration

The remuneration system for directors and auditors consists of basic

remuneration for each position, performance-linked remuneration, and stock-based

remuneration. Outside directors and auditors receive fixed remuneration and are

not eligible for stock-based remuneration.

Basic Remuneration for Each Position

The amount is determined based on the base amount corresponding to the position.

Performance-linked Remuneration

This portion is included to motivate the officers to increase corporate value

through improved business performance. The indicators for the performance-linked

evaluation are consolidated operating profit, in which the performance of our

core business is reflected, and consolidated profit before income taxes, in

which the results of investments and loans are reflected. The amount to be paid

actually is determined based on business performance and the results of the work

for which the officer is responsible.

Stock-based Remuneration

This portion is included to share with shareholders the benefits and risks of

stock price fluctuations, and to motivate the officers to contribute more than

before to the increase in stock price and the enhancement of corporate value.

This remuneration is paid in the form of our transfer-restricted stock, and the

amount is determined based on the base amount corresponding to the position. It

is paid at a certain time each year in the total amount of stock-based

remuneration determined by the Group.

Other Initiatives

Stockholdings

Comprehensively considering the Group’s business strategies and relationships

with its business partners, the Company maintains a policy of holding strategic

stockholdings when these are considered effective in improving corporate value

over the medium-to longterm. With regard to the verification of stockholdings,

we report regularly to the Board of Directors every year. For verification of

stockholdings, we individually qualitatively and quantitatively verify them from

the perspectives that include the purpose of the holding and capital cost, and

we are also promoting efforts to reduce holdings as appropriate. While assessing

the management policy of the investee company, we exercise voting rights related

to strategic stockholdings in an appropriate manner based on whether they will

contribute to the improvement of corporate value over the medium- to long-term.

Policy on Cross-Shareholdings and Exercise of

Voting Rights

- 1. We will hold shares of business partners or others as part of management strategies only when we deem it beneficial for enhancing our corporate value over the medium to long term, comprehensively considering our Group’s business strategy and business relationships with these business partners.

- 2. We will verify the appropriateness of cross-shareholdings on a case-by-case basis qualitatively and quantitatively from the perspective of the holding purpose and capital cost, etc., and make a periodic report to the Board of Directors every year. We will dispose of and reduce the cross-shareholding of the shares that are judged as less worthwhile to hold. (The number of shares disposed of as a result of verification of the value of holding them is disclosed in the Securities Report.)

- 3. We will exercise the voting rights of the cross-shareholdings appropriately upon judging whether they contribute to the enhancement of our medium- to long-term corporate value while ascertaining the management policies of investee companies.

November 22, 2021

MITSUI-SOKO HOLDINGS Co., Ltd.

MITSUI-SOKO HOLDINGS Co., Ltd.

Restrictions on Donations and Political Contributions

When making donations and contributions*, we take appropriate actions in

accordance with the Political Funds Control Law, the Public Offices Election

Law, and other relevant laws and regulations, as well as internal rules.

- * Total amount of political contributions for FY2025 was 500,000 yen.

- HOME

- Sustainability

- Corporate Governance